Providing real estate capital raising, investing and management solutions.

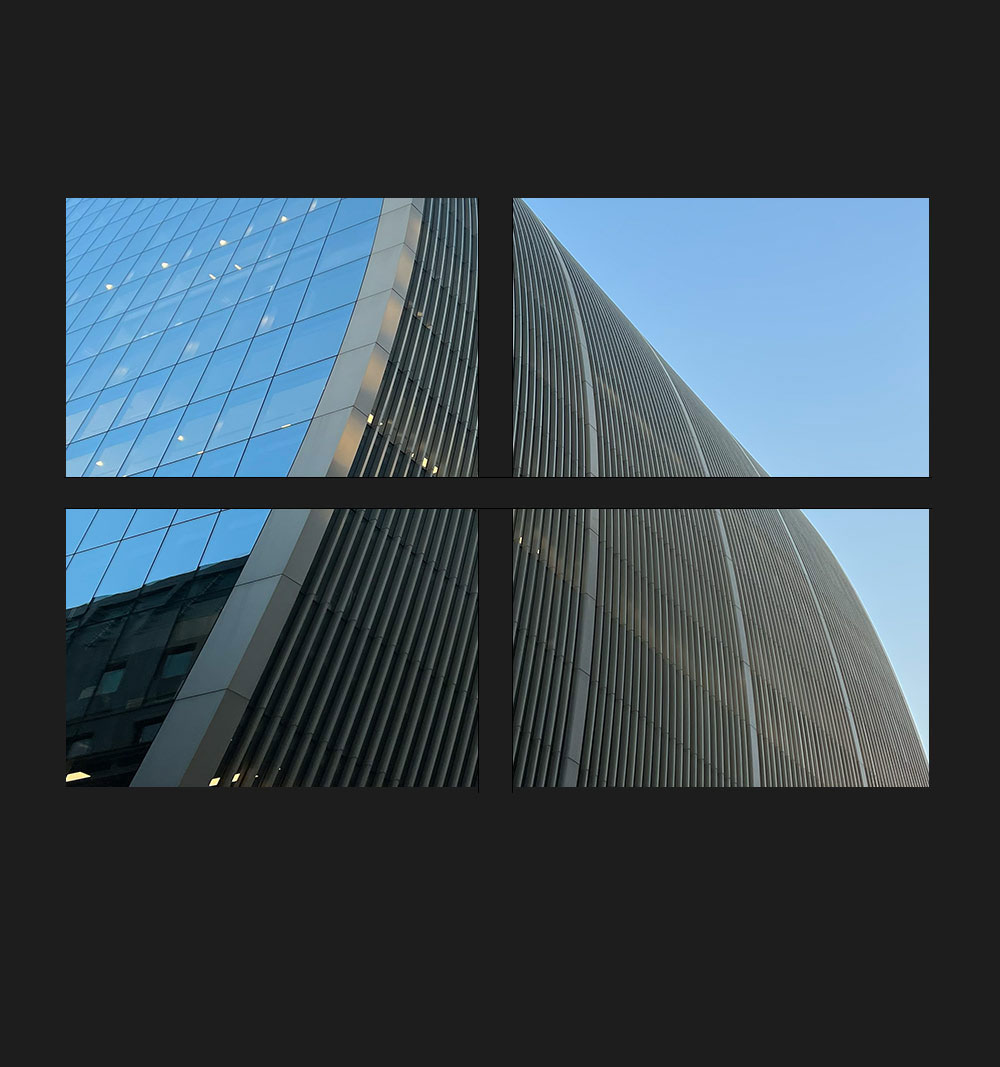

Asset Inspections

Internal and External inspections by RICS Qualified Surveyors with a traffic light based risk assessment / report. Within this we can track the tenancy schedule to actual occupation and provide commentary on repair and condition as well as benchmark rents and yields to comparable assets. Commentary can also be provided on Business Plans and ongoing surveillance / watchlist tracking requirements.

"Our team are with you every step of the way"

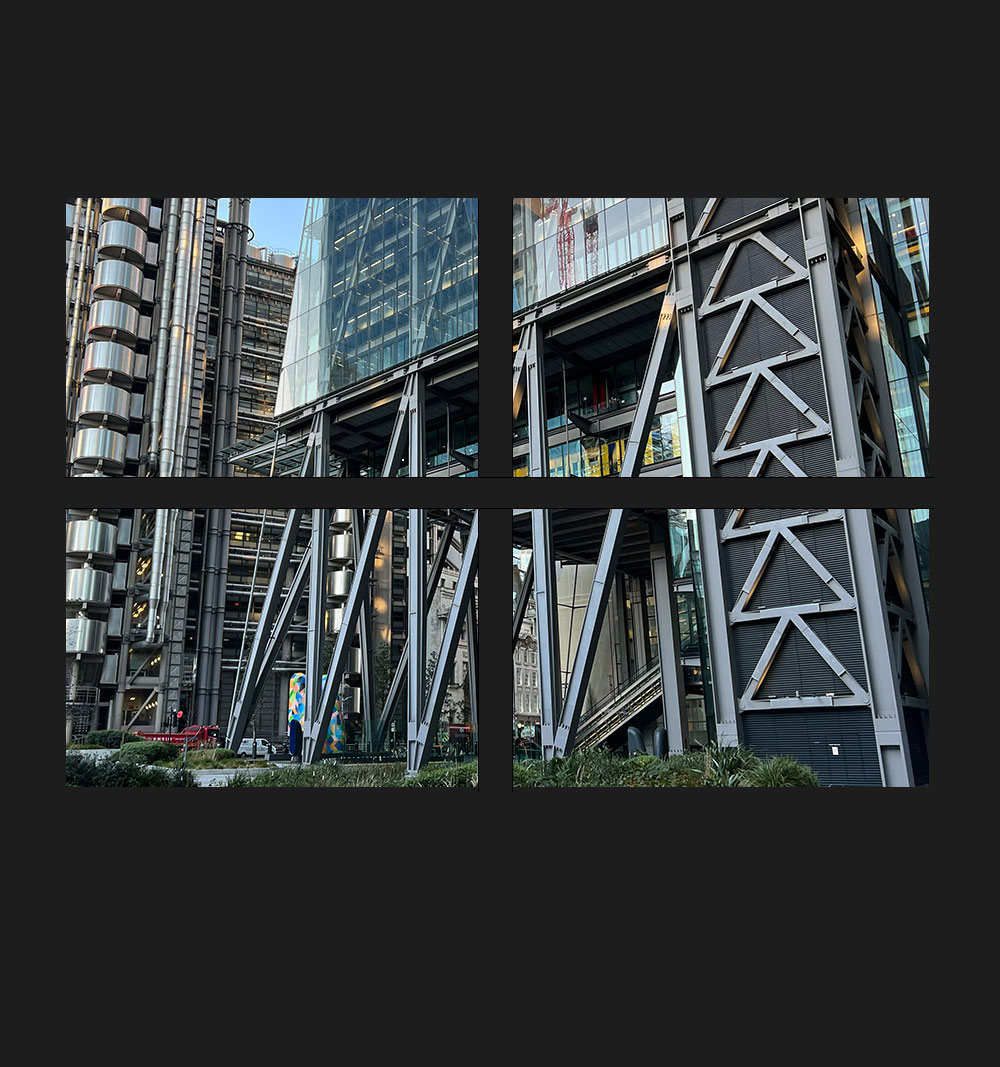

Asset Management

We can deploy a team to manage assets the Lender has taken control over. This can also be provided as a shadow or back-up service to monitor the in-situ Asset Manager, especially in loan restructurings where a Lender requires 3rd party oversight. In any capacity we work to create strong relationships with the staff and tenants to energise thinking and actions. We provide clear and detailed reporting on the Asset along with a monthly cashflow. Whether this is a short or long-term strategy to optimise returns we can also look at capital investment to drive value.

Experienced In Negative Markets

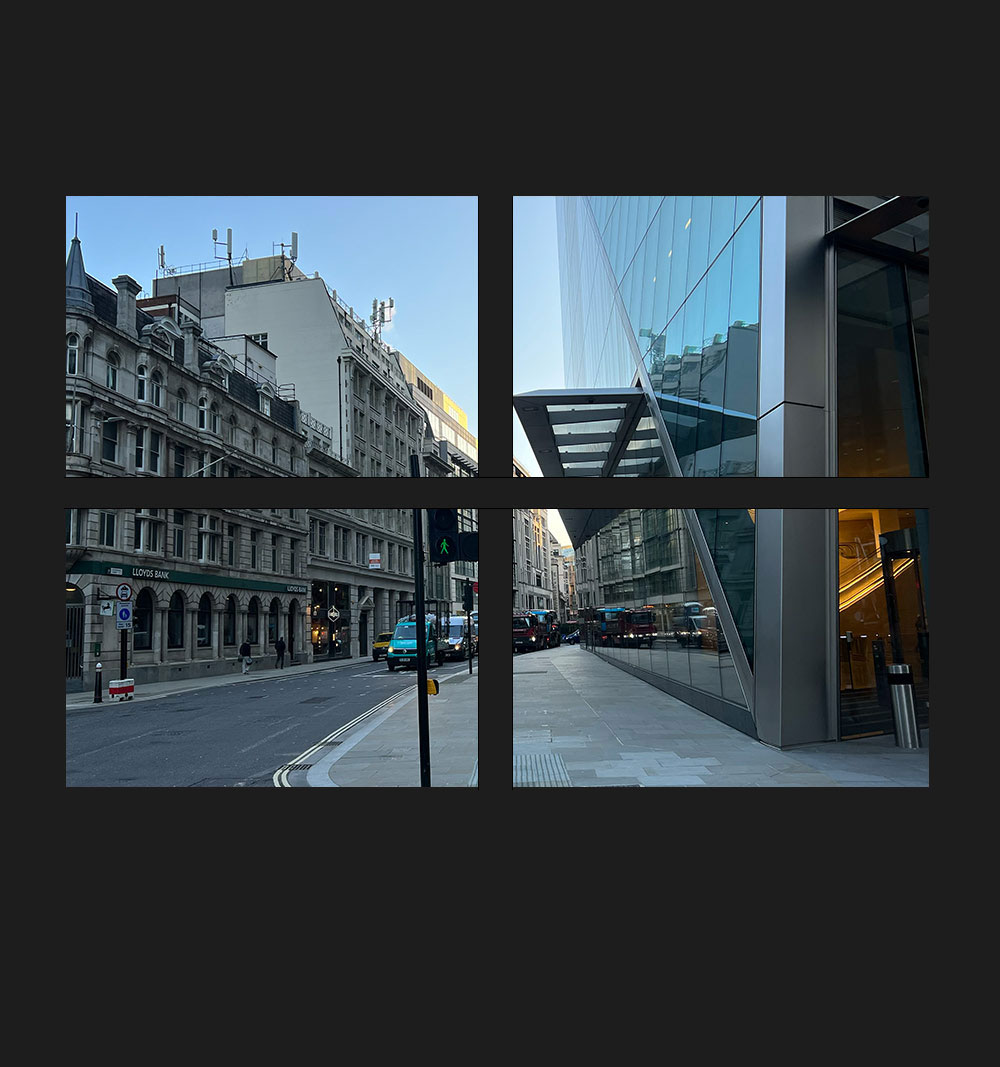

Debt Advisory

For lending requirements that are not straight forward, require flexibility or several layers of structuring, we can work with Borrowers to help find lending solutions. We can then ensure that the Loan is closed, funded and managed in a timely and cost effective manner and monitor the Loan/Business Plan through to fruition.

Providing structured solutions

Director Services

We can provide SPV Directors, Company Secretarial and Accounting services. We can also provide Non-Executive Directors to work alongside Borrower SPV Directors to track Business Plans. We can provide company formation, compliance, domiciliation and tax management services too.

Welcome To The Waypoint Approach

Escrow Agency

We provide Escrow services for the real estate debt environment. We utilise standard agreements which reduces cost and we provide a single point of contact who understands the deal and tailors their approach to suit the transaction specifics throughout the mandate.

We have all your debt advisory needs covered

Loan Closing

We provide a task management and diarised tracking approach to take a term sheet through to document signing and loan funding. Utilising a clear traffic light-based system, we strive to ensure the loan closes in a timely manner and within budget. We work directly with the Lender and Borrower to manage any problems to help control costs and avoid unnecessary legal fees.

We provide effective solutions and transparency

LPA Receivership

The Law of property act 1925 still provides to this day the simplest route to enforcement in England and Wales. We have qualified LPA Receivers who can manage your assets in any receivership scenario and who work to provide transparent reporting along with direct and effective asset management to capture all asset value including Tax offsetting (where floating charges over the Borrower SPV structures can be exercised).

We can oversee the entire transaction journey

Risk Management

We provide tailored reports for CRE Lenders for Surveillance and Watchlist purposes. This can include Business Plan reviews / Annual Reviews / Restructuring Reviews and Scenario Analysis. We can also report on trends in the cashflow / yield / opex / rental growth / loan covenants. We provide real time on the ground information either on specific assets or a portfolio to help a Lender plan and manage any watchlist / regulatory requirements.

A completely new approach to debt advisory

Valuation Support

We can support the Lender and Borrower in the early stages of a new loan to select and engage the right valuer. We can set-up a data-room to facilitate the sharing of asset information and to ensure unfettered access to the property manager / asset manager and letting agents for the asset information. We can then undertake a valuation review process to critique the valuation and finally we check the report is correctly addressed, with the correct PI cover levels and the relevant reliance language.

We have access to over 200 lenders

Workout Plans

Working closely with the Lender we can formulate consensual and non-consensual workout plans to turnaround assets in default or distressed scenarios. The consensual plan is considered to be the preferred plan, but the non-consensual plan B is always ready to be used. Where value can be enhanced through investment, we can look to invest capital to achieve this.